What is receivable management?

Account receivables refer to the outstanding invoices or money which is yet to be paid by your customers. Until it is paid, such invoices or money is accounted as accounts receivables. Also known as bills receivables. You need cash all the time to keep your business running smoothly and ensuring the accounts receivables are paid on time is essential to manage cash flow efficiently.

And as the term suggests, management of your accounts receivable is called receivable management. Basically, the entire process of defining the credit policy, setting payment terms, sending payment follow ups and timely collection of the due payments can be defined as receivables management. Management of Receivables is also known as:

- Payment Collection

- Collection Management

- Accounts Receivables

Interested to know more about accounts receivable? Check out this video!

Objectives of receivable management

Even though management of receivables seems to be simple, but it could become a very tedious task to manage, depending on the nature of your business. As your business grows, your processes also evolve and become more and more complex, thus, the accounting software to manage your receivables must mould itself to match up to your company standards and needs. Now to run a business successfully, what is that one thing that you need? Money! Right? So, to keep your cash inflow at its optimum, it is crucial that you keep a close watch your receivables. Thus, below are some of the primary objectives to receivables management:

Helps improve cash flow

It is obvious that sound receivable management will help business owners keep their cash inflow steady. This process will give you a clear picture of where your cash is stuck while maintaining a systematic record of all sales transactions. It ensures that you have a sufficient amount of cash to take care of your everyday transactions, and you do not give credit facilities over and above your credit policies or credit limit.

Reduces losses incurred due to bad debts

Blocked cash means lack of funds to conduct your everyday activities. No business would want to face any kind of losses. If receivables aren’t managed efficiently, they would result in bad debts ultimately resulting in losses. Receivable management will let you keep a close track on the payment schedule so that you can regularly follow up with your debtors and maintain optimum levels of cash flow.

Improved customer satisfaction

Since receivables management also keeps a track of your buyers and their payment performance, you can improve your relationship with your customers by giving them discounts and offers for maintaining a steady payment record. This also helps increase transparency between your business and your customers, thus building a stronger bond with a lasting relationship.

Boost up sales volume

Receivable management helps increase sales resulting in increased profitability. Businesses can extend credit facilities to their customers which will help them boost their sales volume, as more customers would avail this facility by purchasing products on a credit basis.

Find out how to record accounts receivables in the books of account?

Importance & benefits of receivable management

Management of receivables refers to planning and controlling of debt owed to the customer on account of credit sales. In simple words, the successful closure of your order to sales is determined only when you convert your sales into cash. Till your sales are converted into cash, you need to manage ‘how much you need to receive? from whom? And when?

To do this, you need accounts receivables management, popularly known as a credit management system in place.

Another reason, accounts receivables are one of the key sources of cash inflow and given the volume of credit sales, a large amount of money gets tied-up in accounts receivables. This simply implies that so much of money is not available till it is paid. If these are not managed efficiently, it has a direct impact on the working capital of the business and potentially hampers the growth of the business.

Take a look at 6 tips to manage accounts receivables efficiently

Scope of receivable management

When you do sales on credit, you would certainly need to keep track of the due amounts that your parties owe you. All such dues from your parties will be your outstanding receivables. Managing the outstanding receivables can be critical to your business because it not only helps to understand how much your parties owe you, but also helps you to recover the dues on time and use it for your business, as needed.

- Record and track dues

- Use credit period

- Keep a close eye on long-pending bills

- Payment performance of your customer

Find out how you can manage receivables in TallyPrime here!

Managing accounts receivables efficiently will benefit the business in several ways. The most important is the increased cash inflow by a faster realization of sales to cash. It also helps you to build a better relationship with your customer by not having discrepancies in pending bills and mitigates the risk of bad debts. All these require you to be top of your account’s receivables and you can easily achieve this by using accounting software. It helps you track, monitor, and on-time action on overdue/long-pending bills resulting in an increased inflow of cash that is essential for business growth.

What is Accounts Payable?

Accounts payable is any sum of money owed by a business to its suppliers shown as a liability on a company's balance sheet. In simple words, when you buy goods or services with an arrangement to pay at a later date, such amount till it is paid is referred to as accounts payable.

Accounts payable is also called as bills payable and the total amount that a company is liable to pay is shown as liability under the head ‘sundry creditor’ in the balance sheet.

Example of accounts payable

Max Enterprises purchased goods worth 1,00,000 from Ace Traders. Ace Traders offered a credit period of 30 days within which the bill should be paid by Max Enterprises.

Here, till the date Max Enterprises pays Ace Traders, the amount of 1,00,000 will be called as accounts payables and shown as liability towards creditors in the balance sheet.

Why are accounts payable and its management important?

Any business, whether manufacturing or trading, need to procure the goods or services from their suppliers and most times, you will be offered to pay on a later date. This results in a major source of cash outflows towards the trade payable and therefore businesses must manage it efficiently.

While accounts payable are short-term liabilities that need to be honoured within a specific date, any delayed payment will attract additional charges in the form of interest and later payment charges. Also, delayed payment may create ill-feeling and impacts the credibility of the business which in turn leads to disruption of the supplies.

Accounts payables involve a carrying cost, not just the additional charges for delayed payments but also the other form of cost. Find out by reading ‘Cost of Accounts Payables’

Accounts payable process

An accounts payable process has many moving parts, potentially manual process steps, and multiple people across the organization involved.

The accounts payable process starts right after you have decided to procure the goods or services on a credit basis. The following is the accounts payable process that you get to see in most of the business

- Evaluating the credit policy of the supplier in terms of credit days allowed, delayed payment charges, cash discount on early payment etc.

- Finalize the supplier and procure the goods in accordance with the procurement process followed by your business

- Once the goods are received, account the invoice in the books

- Need to pay special attention to record the due date within which the bills need to be paid

- Track the bills that are nearing the due date and plan to clear. Accounts payables and the ageing report will be of great help here

- Account the payments made in the books and it will good practice to keep a track the invoices against which the payments are honoured

- Send the acknowledgements such as payment advice or any other statement to inform the supplier about the payment that is made.

Taking full advantage of the credit days will help you to manage the cash flow efficiently. While it is easy but not tracking and knowing when to honour bills will prove to be a disadvantage to the business.

Take a look at 6 Tips for Efficient Cash Flow Management

Accounts Payable vs. Accounts Receivable

Sound management of accounts receivables and accounts payables is crucial to assess a company’s financial health. While the two types of accounts are recorded in more or less similar way, it is imperative to keep in mind that one is an asset account and the other is a liability. Now, with the definition above, it can easily be concluded that accounts receivable is the money owed to your business by customers whereas, accounts payable is the money you owe to the suppliers. This gives us a clear understanding of which account is recorded under what criteria in the financial statement of a company. Since accounts receivable is the money owed to you, this will be recorded under assets, and since accounts payable is the money you owe, this will be recorded under liabilities.

Read more on what is the difference between accounts receivables and accounts payables?

Frequently asked questions

Where do I find a company's accounts payables?

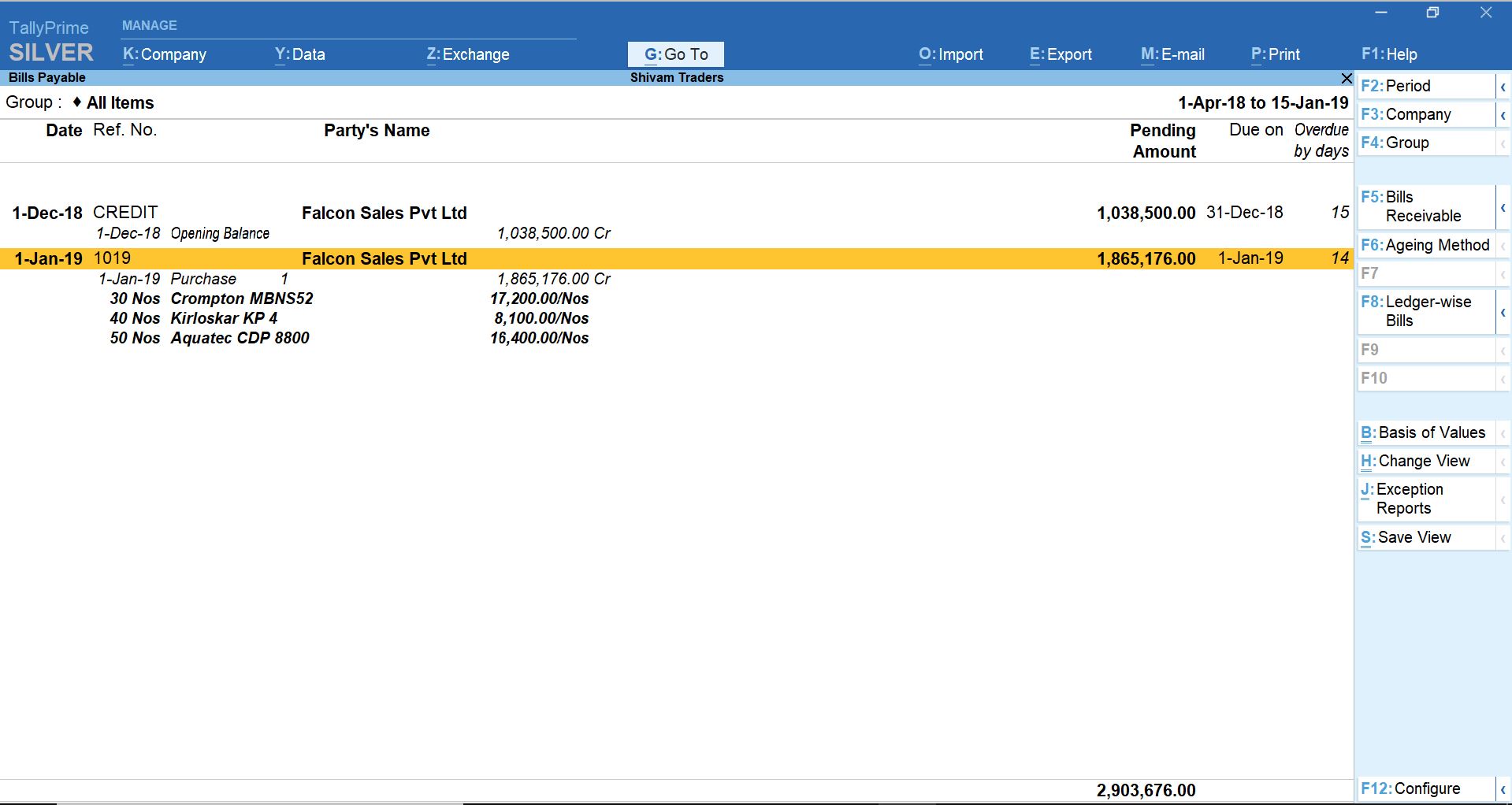

Accounts payables in TallyPrime can be viewed using the following path:

Gateway of Tally> Display more reports> Statement of accounts> Outstandings>Payables

Are accounts payable a business expense?

No. Accounts payable is recorded as a liability account and not as an expense account.

How are payables different from accounts receivable?

Accounts receivable is the money owed to your business by customers whereas, accounts payable is the money you owe to the suppliers.